Why You Should Use Dental Insurance Before Year’s End

Five Reasons to Reach Insurance Cap

The

holiday season is here and filling up our calendars with obligations. Even

though our time is already limited, it may be beneficial to add a few dental appointments

to the list. Give yourself the gift of a healthy smile and make the most of

your insurance this year. When it comes to insurance, “use it or lose it” is

true, especially for dental benefits. Yearlong, you work hard for your benefits

that end up going to waste. Instead of wasting them, maximize your insurance

benefits before the end of the year. Here are a few reasons why you should make

an appointment now.

Save Money

You may be able to save hundreds by using dental benefits before the end of the year. Some insurance plans may run on a fiscal year while others may run on a calendar year. Many dental insurance plans sit with unused benefits until December 31st. Save a bit of money by scheduling appointments now instead of next year.

Dental insurance companies count on making millions of dollars off patients who never use their benefits. It’s up to consumers to make sure they use what remains on their policies and know what they can do to take advantage of their dental plans.

Avoid Deductible Resets

The deductible is the amount you must pay to your dentist out of pocket before your insurance agency begins to provide. The fees may vary with each plan, but the deductible for most dental insurance plans is $50 per year. Your deductible begins again when your plan rolls over and may cause your insurance to provide less coverage. If you have used your insurance, you’re probably closer to meeting your deductible if you haven't already.

Use Up Maximums

The annual maximum is the limit your insurance plan pays within a year. Most plans vary, but the yearly average for one person is $1000. This renews every year but if you have unused benefits, they just go to waste.

Monthly Premiums

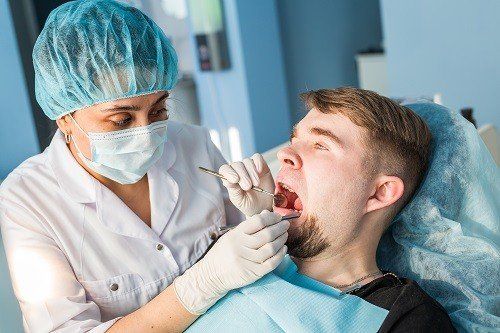

If you're paying insurance premiums each month, you should be using your provided benefits. Even if you don’t need extensive procedures done, you can at least schedule regular cleanings to help prevent any early signs of cavities, gum disease, oral cancer, or other dental problems.

FSA Contributions

Use up your existing flexible spending account. This is an account established through your employer. If you don’t use all your FSA contributions, you lose them. Check with your insurer to see what benefits you have used and may have available for the year, so that you can take full advantage before January 1st.

If you are still looking for dental insurance , consider Wellness Dental Plan. We offer policies for individuals, families, and small business owners! For more information, click here.

Copyright: romastudio / 123RF Stock Photo</a>