Tips for Managing Your FSA

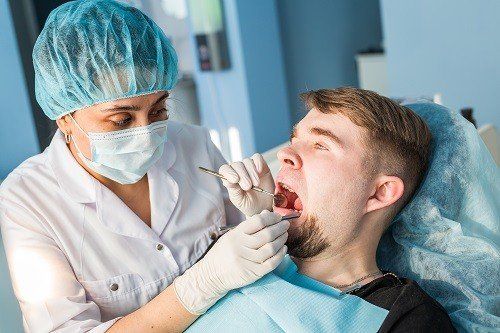

If

you have a health plan through your job, you can use a flexible spending

account (FSA) for copayments, deductibles, prescriptions, and other costs. A

healthcare FSA or arrangement FSA is a great way to maximize your savings for

the year and help plan ahead while reducing taxes. It’s best to take advantage

and put money away for out of pocket health care costs, and this includes

dental costs.

An FSA is a pre-tax benefit account used to pay for healthcare expenses. At the beginning of the plan year, consider how much you want to contribute. Your employer then deducts amounts periodically, maybe every payday as per your decision. Here are a few tips to get the most out of your FSA.

Know Who’s Eligible

A healthcare FSA covers qualified expenses for you and your eligible dependents. Dependents include your spouse, children under the age of 26, children over the age of 26, and domestic partners that qualify as tax dependents.

Know What’s Eligible

There are hundreds of healthcare expenses eligible for reimbursement under a healthcare FSA. Generally, expenses include medical, dental, vision care services, and products that are necessary to treat a specific medical condition.

Keep Your Receipts

The IRS has specific rules for healthcare FSAs, and you always should verify expenses with receipts. Save receipts for any eligible expense you can submit for reimbursement. Make sure receipts include the patient’s name, the provider’s name, date of service, type of service, and cost.

Shop Carefully

Get reimbursed for eligible expenses quickly. See if merchants including pharmacies, healthcare providers, and general merchandise stores are approved for benefits.

Monitor Your Account

Monitor your account to check balances, claims, and expenses and upload copies of receipts, so no expense goes to waste.

A Few More Tips for the Road

Employers can make contributions but are not required to. Contributions made by an employer can be excluded from your gross income, but coverage for long-term insurance must be included. Taxes are not deducted from the contributions, and withdrawals may be tax free if you pay qualified medical expenses.

FSAs

are often limited to $2,500 each year by an employer. If married, spouses can

put up $2,500 in an FSA with their employer. Again, these funds can be used to

cover you, your spouse, and your dependents. However, FSAs do not cover

insurance premiums. Some employers may offer grace periods and carry overs but never

both. At the end of the period, you may lose money that is left over in your

account. Try to plan carefully and keep up with your account. Use it, don’t

lose it!

If you are still paying too much for dental care, consider signing up for Wellness Dental Plan. We offer family, business, and individual discount dental plans that can save you as much as 20 percent off your bill! For more information, click here.

Copyright: mizar21984

/ 123RF Stock Photo