Senior Dental Insurance

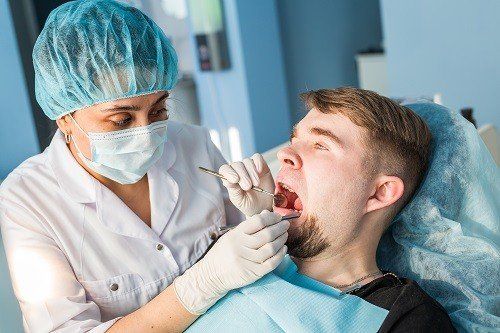

Sometimes, as senior citizens, additional or more specific

dental care is required since, as all of us age, our gums and teeth become more

prone to inflammation, disease, and decay. As well, other health conditions,

such as heart disease, diabetes, osteoporosis, respiratory disease, and stroke,

also can affect oral health and vice versa, as per the ADA.

Because of such risk factors involved, it is often in seniors’ best interests to have dental insurance on hand. For one, 27 percent of out-of-pocket expenses for health care are for dental services—some people even put off necessary dental care due to this expense. To learn more about dental insurance for seniors, read on and get a better idea of what it entails.

Standard Dental Insurance Policies

Usually, dental insurance is not offered within significant health insurance plans, such as the kind many are offered via their employer, but people, seniors included, can purchase their own dental insurance policy to cover a few of the costs with a typically low-cost monthly premium.

Dental insurance does often require a waiting time for expensive treatments, meaning you shouldn’t put off getting dental insurance until you need it to buy it. Standard insurance plans for dental care include biannual exams and cleanings. Other services sometimes involve a copayment or a deductible, such as x-rays, extractions, fillings, and restorative procedures like deep cleanings, crowns, bridges, and root canals.

Additional Dental Policies Seniors May Require

Beyond routine fillings and checkups, some insurance policies cover a portion of the costs for other dental services, some of which include but are not limited to the following:

Dentures : For denture fittings, patients typically require many tooth extractions, which makes it a considerable procedure involving possibly more than a few visits. A few family dentists can fit individuals for dentures though specialty dentists are likely more acquainted with the process and can have a quicker turnaround.

Periodontics : Periodontal disease has numerous forms and can ultimately destroy the bones that support the teeth. To treat this condition, patients may receive dental implants as well as inflammation treatment. Specialists are usually required.

Endodontics : Root canals, which remove diseased or decayed pulp in teeth, are most commonly how endodontics is used. A regular dentist can usually perform this or a specialist may be referred.

Orthodontia : This service, which most dentists offer, involves braces for aligning crooked teeth.

Implants : Adults who’ve lost several teeth because of decay or an accident can receive dental implants, which can eliminate the necessity of a bridge, as implants feel, look, and work like regular teeth. Oral surgeons rather than family dentists usually perform this service.

Cosmetic services : Whitening, veneers, and bonding can be covered in some dental policies.

Dental Plans

Specifically, for seniors, two major kinds of personal dental insurance plans are usually the best fit, and they can be found below:

Managed-Care Plans : Also called preferred provider organizations (PPO), these plans negotiate dental fees with particular in-network providers. These providers only request your share of the costs and file necessary documents for you. Procedures by out-of-network providers can be covered, but it is often by a smaller amount.

Indemnity Plans : These plans typically include more providers, meaning seniors could see their preferred dentist. However, patients often must pay the whole bill immediately before filing a claim to reimburse a procedure.

If you are a senior trying to figure out how you will be able to pay for your insurance, consider a New Hampshire senior discount dental plan for individuals and families like the Wellness Dental Plan. You can save as much as 20 percent off your dental bills! For more information, click here.

Copyright: racorn

/ 123RF Stock Photo